As it has been some time since my last article on SeekingAlpha, I believe it is time to give an update on the net-net investing space. My latest pick is Voxx International (VOXX), which is a classic Ben Graham net-net stock trading at 2/3rds of net current assets. Net-net, NCAV, or cigar-butt investing is a (mostly) quantitative investment strategy that consists, at its heart, of buying companies at a steep discount to their liquidation value.

"It always seemed, and still seems, ridiculously simple to say that if one can acquire a diversified group of common stocks at a price less than the applicable net current assets alone—after deducting all prior claims, and counting as zero the fixed and other assets — the results should be quite satisfactory."

-Ben Graham

In this article, I will analyze the common stock of Voxx International from this standpoint. Such a valuation is considered to be extremely conservative, especially for a company that has positive net income and is at an intermediate-term low price.

Profile

Voxx International is a vehicle electronics manufacturer headquartered in Orlando, Florida. They own a broad portfolio of consumer brands, notably AudioVox, RCA, and recently a strategic partnership with Solo, which can detect children left behind in hot cars.

Voxx is an older company, founded in 1960, and has always stated their focus on innovation for their customers. It seems to have paid off – Voxx entertainment systems are used in Ford, Mazda, and GM cars, and various other products have been purchased by virtually every major auto company.

However, the vehicle electronic components business is not the most wonderful business line to be in, and Voxx has been plagued by declining revenues and operating earnings for years. This picture is somewhat better from a cash-flow perspective, though in the past year cash flow dipped to -$16mm. Voxx has initiated a buyback program, and as of their last 10-Q filing 2.5mm shares remain authorized to be bought back. One wonders if that occurred at the recent local bottom.

Despite substantial loss-making business lines, the buyback program and strategic acquisitions point towards a commitment to shareholder value – a refreshing factor for a small, somewhat troubled business. Voxx's management has also outlined several key strategies in their recent earnings presentation, notably reorganizing some business units, reducing fixed costs, and improving their bottom line.

Acquisition of Vehicle Safety Holding Corp

I believe the acquisition of Vehicle Safety Holding Corp, announced in early February, will be notably value-accretive to shareholders and is quantitatively a great deal in today's market. My single doubt here is that the revenue ($28mm) is simply too small to really move the needle for Voxx, but the extra $3mm of EBITDA would be quite welcome. Voxx paid $16.5mm for this business, which is roughly a 0.59 price to sales and just 5.5x EBITDA – a steal no matter who you ask.

Assets

As many of you who follow me on SA know, I like to know and understand the numbers. Voxx is not terribly cash-rich, holding $32.1mm prior to the acquisition and $15.6mm after. This is followed by $93.3mm of accounts receivable and $111mm of inventory. Typically, the concentration in lower-quality current assets should raise a few questions. This comes out to a total of $248mm in current assets pre-acquisition.

Voxx carries a substantial amount of intangible assets and goodwill as well – $170mm in total – which runs substantial risks of being written down at the expense of quarterly EPS. Virtually all of its tangible book value is made up of working capital.

The balance sheet is not terribly levered with $111.5mm in total liabilities, most of which is either accounts payable or accrued expenses. Voxx holds just $6mm in long-term debt, for better or worse. I would not mind seeing additional leverage being taken on at favorable rates to ensure that the company is not dependent on short-term obligations to finance its day to day operations or further expansion.

These figures place Voxx's net current asset value at $136.5mm prior to the acquisition of Vehicle Safety Holding Corp., and $120mm after – or $5.64 and $4.95 per share, respectively – against a share price of $2.92. Though quantitatively the acquisition decreases NCAV/share, I believe it was acquired at such a cheap price that the intrinsic and liquidation values of Voxx are likely increased meaningfully despite the cash decrease. Adjusted for this acquisition, Voxx currently trades at 60% of net current assets and about 2.15x net-net working capital. Without that adjustment, Voxx stock is just 53% of NCAV and 1.42x NNWC. This is a very compelling margin of safety.

Earnings and Cash Flow

As discussed above, Voxx has been troubled by declining revenues and operating earnings until very recently. The market likely was expecting an even better turnaround – revenues were up 22% QoQ, but down comparably over the same period one year ago. Operating earnings and EPS were barely positive – operating income was just $100k – while gross margins have held roughly around 28% for some time.

There is some better news on the cash flow statement – before asset writedowns, depreciation, and amortization, cash flow from operations is positive $16.5mm over the last twelve months. This strongly indicates that there is value in Voxx's cash flows left to be unlocked.

Risk Factors

Voxx's common stock has a number of possible – though not necessarily probable – risk factors moving forward, largely due to its poor trends in revenue and fairly large net losses.

One obvious risk is dilution of equity or other capital raises that diminish the per-share claim to cash flows or raise debt on unfavorable terms. This is, however, a risk that tends to not materialize outside of certain industries, like biotechnology and resource exploration, but can still happen here.

A more common risk to net-net stocks is that of entrenched management, one that acts in their own interests at the expense of shareholders and essentially drives the stock to zero over a period of time. I do not believe this is a material risk to Voxx, however, since management has acted in a pro-shareholder fashion when given the opportunity, but this risk is always present in any company.

Another common risk is that cash burn continues, and drives NCAV down to or below the current share price. There is not much we can do to avoid or predict it, beyond avoiding fundamentally speculative businesses with high, regular cash burn rates.

There is also the possibility that Voxx stock simply never trades at net current asset value, and remains undervalued indefinitely. While this is a rare occurrence, it is not impossible, and Voxx has floated above and below NCAV for a number of years.

By far my largest concern is that Voxx has a single controlling shareholder, Mr. John J. Shalam, and two separate classes of stock which have unequal voting power. Mr. Shalam controls "substantially all" of the Class B stock, which has ten times the voting power of the publicly traded Class A shares, and has ~52.5% of the total voting rights. Mr. Shalam founded Voxx and was its CEO from 1960 through 2005, and has a number of family members on the Board of Directors. One wonders if this is a case similar to that of Westell Technologies, another family-controlled stock that has gone through substantial value destruction.

Sum of the Parts

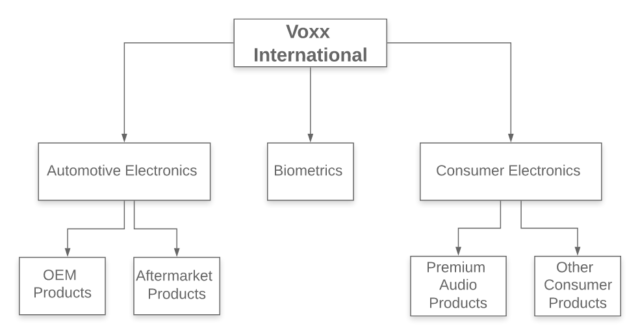

Voxx International has a large portfolio of business lines and brands, segmented on their filings into Automotive Electronics, Consumer Electronics, and Biometrics. Each of these major business segments is further broken down by product type:

Voxx's Biometrics line generates negligible revenue compared to other business lines – around $500k per year – but is viewed as a potential driver of growth despite declining revenues year-over-year. Biometrics lost $2.8mm in the past quarter, so it is reasonable to say that it is detracting somewhat materially from the bottom line, especially since losses exceed total sales. Low and shrinking revenues mean that even at 4x sales – a very generous price – a sale of the Biometrics line would do little for the top line or the balance sheet, but could serve to reduce costs and streamline operations. Biometrics seems to detract from the value of Voxx – possibly to the tune of tens of millions – so I would argue divestments here would enable management to refocus on core, higher-revenue business lines with more opportunity to improve while effectively adding over $3mm to Voxx's total EBITDA right away.

Consumer Electronics is responsible for the bulk of Voxx's revenue, generating $79mm out of $110mm in total sales for the quarter ending November 30th, 2019. It is also the highest-margin segment, generating $13mm in EBITDA over the past quarter, or $52mm annualized. This segment alone, applying a 6x EBITDA multiple, seems to be worth over $300mm on its own despite slightly shrinking revenues (-3.3% YoY), a problem that is far from uncommon at this stage in the economic cycle.

Automotive Electronics is facing much more serious problems than Consumer Electronics, with revenues falling more than 30% since fiscal 2018. This is almost entirely due to the OEM Products sub-segment, which has seen revenues fall by roughly half. EBITDA has effectively collapsed, and the segment barely broke even on net income in the past quarter despite doing nearly $30mm in sales. Though this is Voxx's original business line, it is clearly facing major problems and bringing in outside help could greatly enhance shareholder value here. Seeing as it only generates $1.6mm in annualized EBITDA based on the past quarter, it is safe to say that the Automotive Electronics segment is worth somewhere between $8mm (5x EBITDA) and $85mm (~0.7x sales). This suggests a very large amount of value left to be unlocked, and a divestment at a fair price would not be unreasonable.

Conservatively assuming that Voxx overpaid for Vehicle Safety Holding Corp. and it adds only $2mm in EBITDA, let's apply a 5x multiple of EBITDA. This implies Vehicle Safety Holding Corp is worth $10mm – a very conservative figure, seeing as it was bought at over 50% higher.

Following these valuation multiples, we arrive at a sum-of-the-parts valuation of Voxx in the range of $278mm to $390mm, likely on the lower end. Voxx's current market cap is just $87mm, suggesting over 219% upside if the company were broken up and sold off. Because Voxx's capital structure is heavily weighted in short-term payables, I believe a calculation of enterprise value is most appropriate using total liabilities less cash rather than net debt, which places Voxx's adjusted enterprise value at $183.5mm. This figure still implies over 46% upside if the same multiples of EBITDA are applied, which is very conservative. Virtually no matter how you slice it, Voxx is trading far below its liquidation value.

Recommendations for Management

In order to raise cash and cut costs, I believe that Voxx should pursue divesting some business lines and hard assets (which they have done with German real estate). This is generally a successful strategy to enhance shareholder value, and can be done in tangent with a buyback program or value-accretive acquisitions. I am personally inclined to divest those business lines with rapidly falling revenue (OEM Products, Other Consumer Products, and Biometrics) since it is likely that another business or PE firm could extract more value than Voxx is able to, while also enabling management to focus more on the businesses they are best at running.

Another vital piece moving forward is improving the bottom line. Voxx runs (a relatively fixed) over $100mm per year in SG&A expenses against roughly that much in gross profit, which suggests quite a bit of corporate bloat and an opportunity to improve, especially when revenues are falling.

Though it appears Voxx has made some short-term improvements, I believe that bringing in outside consultants or investment bankers to more closely examine operational improvements and strategic alternatives would be extremely beneficial to the company and its shareholders. A neutral third-party perspective helps to trim the fat and identify areas of opportunity that those involved in day-to-day activities simply cannot see.

Bull Case

As with all cigar-butt style stocks, there are a few possible outcomes here. The most common is the share price rising up to meet NCAV, in which case the shareholder gets to pocket a respectable profit and an embedded option to buy the underlying business for effectively free if prospects have improved. Obviously, exercising this option is not part of a pure net-net investing strategy, but is not entirely worthless.

Bear Case

However, there are a number of risks that can cause that case to not play out. These include those risks discussed above – capital raises, entrenched management, cash burn on operations, never trading above NCAV, or a controlling shareholder not acting in the company's best interests – as well as cash being squandered on value-destructive acquisitions or the stock getting bought out below NCAV.

Special Situations

There are a few special situations that do not fall under either the classic bull or bear case for net-nets. One fairly common outcome is a buyout by a PE firm or competitor, in which case the stock becomes a play on merger arbitrage rather than a true net-net, and you will likely be able to realize at least net current asset value. This occurred with CSS Industries (CSS). Shareholders there pocketed substantially more than NCAV. A similar situation would be partial divestments, like what Schmitt Industries (SMIT) has pursued and has made moderate fundamental changes to the stock. I would prefer the latter.

Another scenario is where the company decides to liquidate and then pays out the proceeds to shareholders. If your estimate of liquidation value is accurate, you stand to make a respectable profit here. Support.com (SPRT) is the closest example that comes to mind here, though they are not technically liquidating at this time.

A poor outcome may come from a number of tail risks, most notably fraud. This tends to occur in Chinese firms or those who do a considerable amount of business in mainland China, but even large American companies are not immune. Lawsuits are another tail risk that can wipe out equity – it is best to avoid stocks with pending lawsuits that run that risk in any material way, especially if it pertains to fraud.

Voxx is a very cheap stock and has only traded this low once since 2017. I believe management is shareholder-friendly and have general faith that the controlling shareholder will not behave rashly and risk wiping out value. I do have some concerns regarding the success of the company's turnaround story and cash burn, as well as a relatively lower margin of safety due to concentration in lower-quality current assets. Voxx likely presents a rare opportunity with mid-double digit upside in the intermediate term, since virtually all negatives of the stock are priced in with no weight given to its positives.

Disclosure: I am/we are long VOXX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Komentar

Posting Komentar